Want Quick Money? Try These Methods! 👇

- Survey Junkie: Get paid per survey through this link with one of the highest-paying survey sites on the web.

- Arrived: If you want a simple way to earn extra cash on the side from your phone, look no further than the best real estate platform that pays you passive income.

Want to get a big tax refund come tax filing season? Try these 4 tips to learn how to get a bigger tax refund.

As we move into a new decade, it’s important to establish good money habits like practicing Dave Ramsey baby steps so you can improve your financial situation and work towards semi-retirement.

Taxes, in particular, are an important aspect of financial literacy that should never be overlooked. Though tax season is something that’s hard to look forward to, there are ways you can maximize your return in order to ensure you are either getting a refund or at least minimizing the amount of taxes you will have to pay.

Failing to maximize your return and making mistakes can result in you paying more in taxes than you have to, or even underreporting your income and setting yourself up for interest and fees. There is still plenty of time for you to make changes and adjustments before Tax Day so you can lower your taxes and make the most out of your earnings this past year.

Practicing these healthy tax habits every year will ensure you are getting what you deserve and is going to lead you to a healthy, long-term relationship with your finances.

1. Determine if a Standard Deduction or Itemized Deduction Will Give You the Best Returns

Standard deductions are fixed dollar amounts that reduce the income you are taxed on. They vary depending on your filing status. For example, those filing as single receive a deduction of $12,200, whereas the head of household taxpayers get a standard deduction of $18,350. Approximately two out of all three returns use standard deductions because of their ease of use. They don’t require you to itemize deductions like medical expenses or donations and give you a deduction despite having no expenses that qualify for itemized deductions.

Itemized deductions, on the other hand, reduce your taxable income but are not a fixed dollar amount. They are tax deductions you receive for various expenses you incurred throughout the tax year. Some common itemized deductions include charity donations, large, out-of-pocket medical or dental expenses, mortgage interest, and real estate taxes. If your itemized deductions exceed the standard deduction for your respective filing status, it might be worth putting in the extra work to maximize your tax return.

It’s important to stay up-to-date with the changing deduction laws in order to maximize your tax return. In the past few years alone, annual adjustments have changed, standard deduction rates have increased, personal exemption has gone away, certain credits have increased, and some tax deductions have been removed. If you want to make the most of your earnings and maximize your tax return, you will have to be aware of all the changes that will affect your return. Starting with making a decision between a standard deduction or itemized deduction and then seeing how the new laws will affect your return is a good place to start.

Contribute More Towards Retirement

One of the best and easiest ways to take advantage of your taxes now and also later when you retire is by utilizing retirement accounts like your 401(k) and IRA.

In fact, according to FinanceWrite.com, the contribution limits for 401(k) plans have been raised for 2022, meaning you have the opportunity to protect more of your income from taxes.

The 401(k) contribution limit for 2022 has been increased from $19,000 to $19,500. If you use this increase to your advantage, you can maximize your upcoming tax return even more. Paired with your employer’s match program, if offered, will be great for your long term financial plan.

Donate to Charity and Claim Available Deductions

Giving away and donating your old belongings will not only clear up your living spaces this new year, but is a great way to earn tax reductions and help out the less fortunate. Donating items, money, or volunteer hours to any charities recognized by the IRS is truly a win-win situation for everybody.

If you volunteer at a charity, out-of-pocket expenses like the money you’ve spent on gas for the charity can be tax-deductible as well.

As long as you are meticulous with your receipts and the money you spend on donations or charity, you will be able to accurately value and track your donations in exchange for deductions come tax season. Just make sure you are only claiming deductions for charities that are tax-exempt with the IRS.

Contribute Towards Your Kid’s College Fund

Starting a college plan like a 529 for your kids is a great way to give yourself tax benefits all the while saving for their educational expenses later down the road. Although contributions to 529’s are not tax-deductible, the investments you have within the plan collect tax-free. That means the investments can grow, taking advantage of tax-free compounding, until they are taken out. Many states also offer deductions or credits for 529 contributions.

If your child is attending a private elementary school or high school, you can also open 529 plans to pay for tuition.

Opening 529 plans are practically as easy as opening up a savings account. Your local bank should be able to help you get one setup.

Review Your Flexible Spending Account

If you have an FSA plan with your employer, you are having pre-tax money taken out of your paycheck so you can use it for qualifying medical expenses that are not covered by your insurance. This is advantageous for you because those contributions reduce your taxable income while allowing you to save up money for medical expenses that aren’t covered by your insurance.

If you still have money left in your FSA, make sure you use it on doctor’s appointments you might have been putting off. Depending on your plan, you may lose a portion of the money that you have been saving.

What to Do With Tax Refund? Here's What to Do With Your Money

Looking to maximize your tax return?

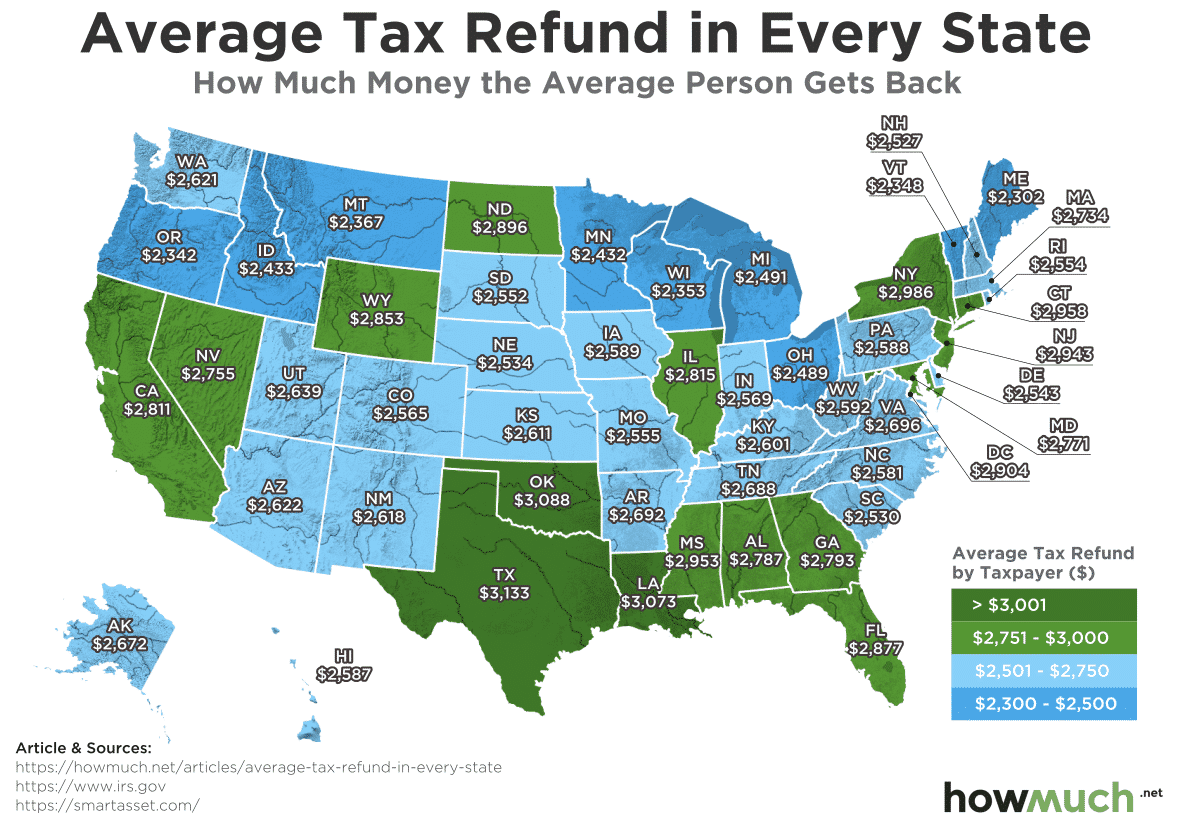

Tax season is right around the corner and that means the average US resident is about to see a $2,895 check coming their way. In 2019, US taxpayers gave the IRS a $253 billion dollar loan. That’s a lot of money headed back into the market.

Before you go out and blow that refund on a vacation, you should be thinking how you can take it and grow it into something more. Remember, this is your hard-earned money, and you should use this lump sum as an opportunity to invest.

Invest in a Startup

It could be your company or the company of a friend or coworker. If you or somebody else has an idea that you believe in, you may want to consider investing in it. Getting in on the ground floor of a company that could grow to a large scale in the future can have an incredible payoff. Most investors ask for a piece of equity (an ownership stake) in the form of shares in a company that is commensurate with how much you’re investing.

Exactly how many shares, or what percentage of ownership, will largely depend on a negotiation between yourself and the person who is starting the business. You will want to ensure that the exact terms of your investment are made in writing, and as with any investment you need to understand that you could potentially lose all of the money you put in.

Pay off Debt

Your tax refund might represent the largest lump sum you receive in the entire year that isn’t immediately committed to some living expenses. It is a great opportunity to pay down, or pay off debt that you have generating interest. It might be tough to pay off a loan or credit card balance knowing full and well that you won’t see that money anymore, but your savings in interest can be seriously worthwhile.

Our best advice is to start with your highest interest rate debt first (this tends to be credit cards & personal loans) and then make your way down to debt that carries a lower interest rate.

Invest in Energy Saving Home Renovations

Simple and affordable investments such as energy-efficient lightbulbs, new weather-stripping, or replacing the air filters in your HVAC system can end up saving hundreds or thousands of dollars a year in heating and cooling costs. As for plumbing, you could look into more efficient showerheads or an efficient sprinkler system if you water your yard. All of these things are small initial investments that can pay dividends in a short amount of time.

Invest in Peer-to-Peer Lending

Online lenders such as Lending Club, PeerForm, and Prosper can give you the opportunity to generate a 5 to 15% annual return on investment (ROI) for money that you use to help fund loans for borrowers. With as little as $25 you can get started investing in a small part of loans to people for various different reasons such as debt consolidation, home improvement, student loans, payday loans, and more.

Perform Preventative Maintenance on Your Car

Sometimes preventative maintenance is the best kind of maintenance. Did you know that commercial airlines invest in preventative maintenance because it increases safety and saves money in the long run, by preventing maintenance delays or cancellations when they are most inconvenient? Oftentimes, we think about going to a mechanic only when something is broken. This can end up being expensive though, as towing fees and shop fees wherever you break down can add up quickly.

Preventative maintenance can be a great opportunity for a mechanic to look over your vehicle before something breaks, and even tune things up to get your car running more efficiently and saving fuel.

Start a Rainy-Day Fund

According to the Federal Reserve, 40% of Americans couldn’t cover an unexpected $400 expense. That is a sobering statistic representing the true depth and scale of the financial instability in the United States.

For your part, simply putting your tax refund into savings might be a good idea. Unexpected expenses can come at any time, and we would recommend that everybody be able to live comfortable for at least six months completely off of savings in a “rainy-day” or “emergency” fund.

Invest in Your Education

Is there a class or professional certification that you have been interested in that could advance your current career or be used to make money on the side? In the end, you are your greatest money-making asset. An education in something that can better yourself is important. Even career professionals with a PhD can always benefit from a more in-depth education.

Donate to a Political Campaign

If you are a small business owner or self-employed, investing in a political campaign or cause can pay dividends in the long run. For example, local politics can have a drastic impact on the direction and health of your small business. Building relationships and investing in the campaign of local politicians who share your values can be of great benefit.

Donate to a Charity

While donating to a charity might not have an immediate and tangible monetary benefit, it certainly will build up your karma points. If you are in the right financial position to donate to a charity, this can be a great way to spend your money and benefit society as a whole. Pick a charity that you feel strongly about, research them thoroughly, and make your donation. As a side benefit, your donation will likely be tax-deductible, which can go a long way towards reducing your tax liability in the current tax year.

Final Thoughts

Whether it’s donating to a political campaign, starting a new business, or making some small home improvements, the check or direct deposit you’re about to receive is an incredible opportunity to better yourself. Use it wisely and look for unique opportunities to invest your hard-earned money. The temptation to go out and spend that lump sum can be extraordinary, so set goals for its use now so that you have a plan when the money arrives.

Want free money?

|