Want Quick Money? Try These Methods! 👇

- Survey Junkie: Get paid per survey through this link with one of the highest-paying survey sites on the web.

- Arrived: If you want a simple way to earn extra cash on the side from your phone, look no further than the best real estate platform that pays you passive income.

What are Prediction Markets?

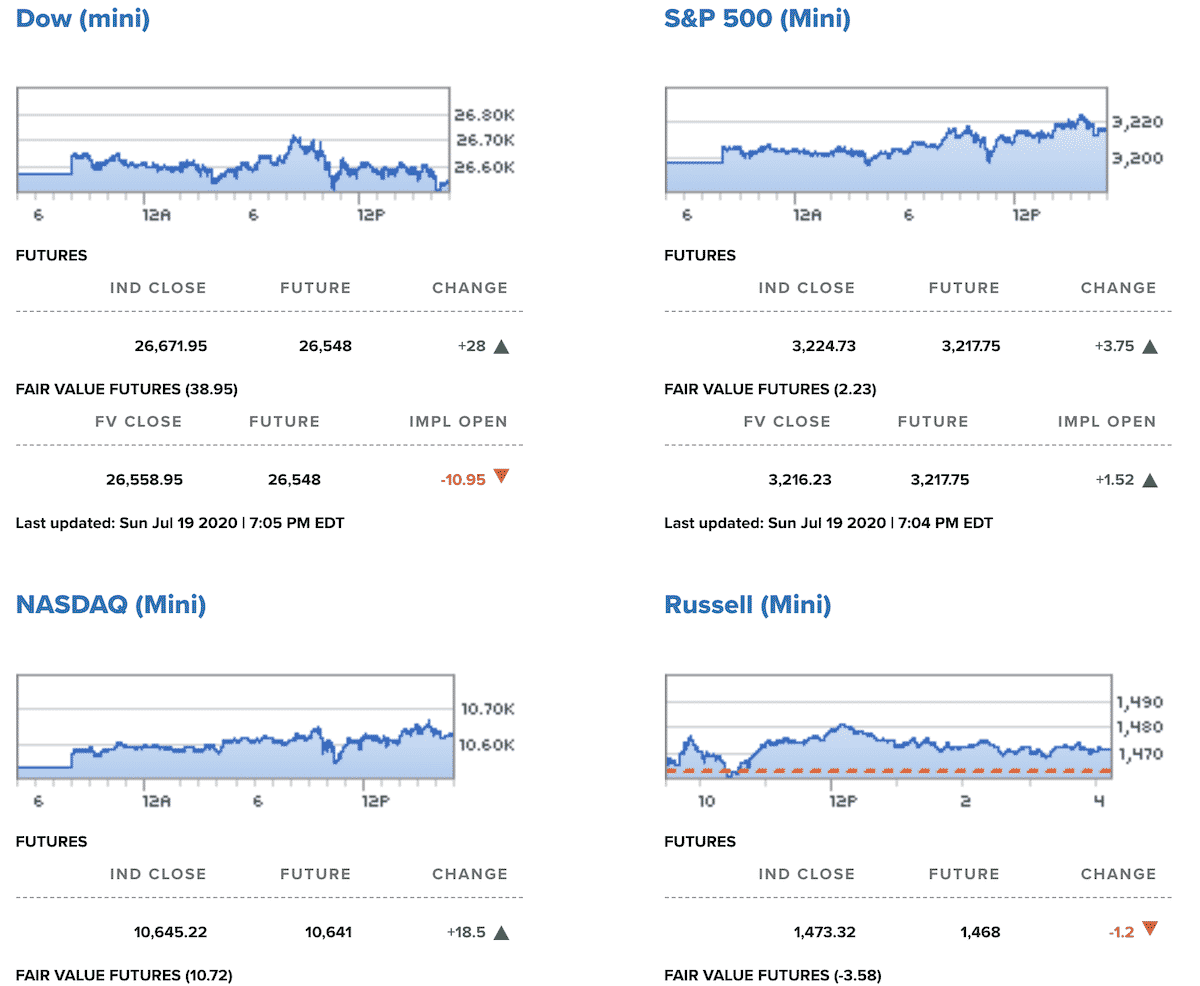

At its core, prediction markets are similar to how the futures market is for the stock market.

It’s based on a binary event where something either will or won’t happen. In the finance world, participants trade with contracts in stock market futures where the payoff will vary depending on the outcome of a future event. Prediction markets make the result of this future event tradeable.

Essentially it’s placing a bet on the probability of specific results in certain situations, such as elections, sales of a company, price fluctuations of commodities, even changes in the weather.

The value of a bet will in most cases reflect the probability of an outcome materializing.

While Bitcoin uses blockchain technology to decentralize the exchange of information, this computing process also has many other applications with the same benefits.

One of the examples is the prediction market, which allows its users to buy or sell shares on the outcome of any event. These actions have an estimated price of the probability that the event will occur.

For example, if a prediction market predicts that Donald Trump will soon sit in the White House Oval Office and the probability amount is 40 cents, it means that there is a 40% chance that Donald Trump will win the presidency of the USA, according to that market. As you can see, you can easily play games with crypto.

Imagine a decentralized predictive system based on this technology, where different users can validate the event in question if it should happen.

Each one of them would be authorized through a few points of reputation and credibility, which would validate them as witnesses of the events that would be presented in the future. Without mediators, censors, or central entities.

As we already know, the decentralization favored by the blockchain prevents the market from being abandoned by the central entity, which could be abruptly closed by the government authorities.

What Are the Best Prediction Markets?

To understand decentralized prediction markets, it is necessary to explain the concept of prediction markets.

A prediction market is a platform over which results of events are predicted.

This can be, for example, the outcome of a presidential election or the spread of a disease, soccer prediction market or, football prediction market.

List of Best Prediction Markets?

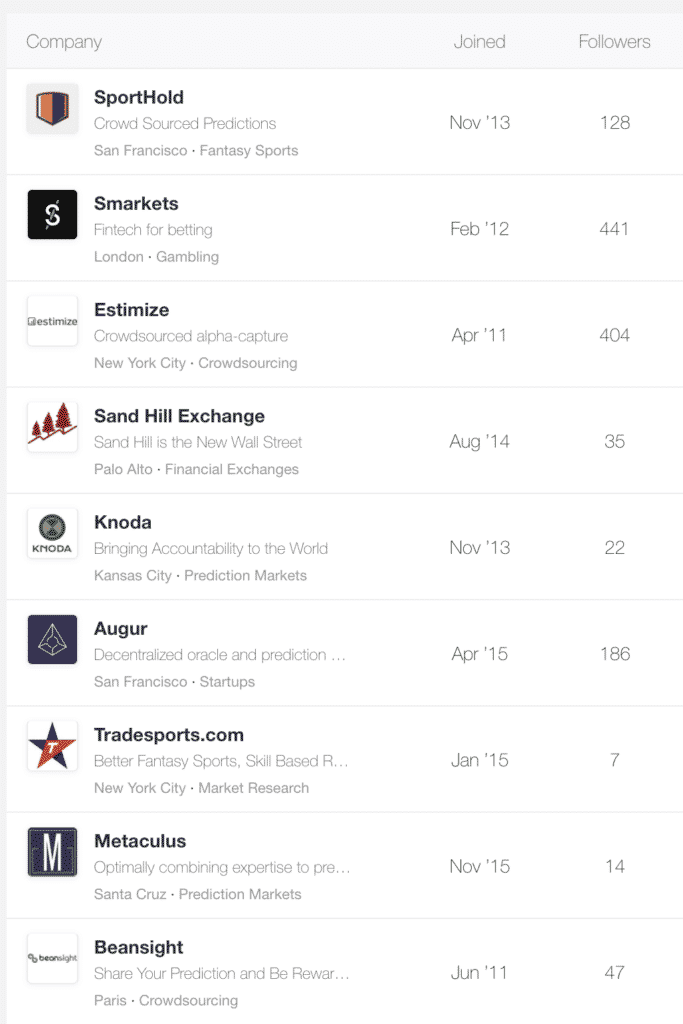

Of course, the exact implementation of a prediction market can vary, as well as the topics for the predictions to be determined. In the following example, a few forecast markets are presented.

Virtual Securities Markets

In fact, there are also virtual securities markets that serve as prediction markets. Here, not significant amounts of money or legal rights are traded, but a virtual share stands for a future event or market condition. Comparable are these virtual securities markets with the known stock market games. However, in the stock market games usually, the price of real stock exchanges are taken over, which is not the case with the virtual stock exchanges. Prediction markets have their own trading mechanisms for this.

Political Prediction Markets

Political prediction markets basically function like virtual securities markets, only the focus is not on companies but on parties or politicians. Specifically, these are future stocks (futures) on an election result. On political prediction markets, the difference to election surveys becomes clear once again. In this prediction market, the participant is not asked which party he would choose, but what he believes, which party is elected.

Online Betting Exchanges

In addition to virtual securities markets, online betting exchanges are probably the most well-known prediction markets. Here is the outcome of a sporting competition or any other social or political event. Betting is bet against the other betting participants and not against a bookmaker.

Most Popular Prediction Markets

You can see the rest of the list here.

Prediction Markets FAQs

How do prediction markets work?

Participants handle the predictions in the form of trading. There is a “buyer”, a “seller” and a middleman. The agent is the operator of the platform in forecast markets. Basically, all trading on the platform is binary options: the transaction is based on something happening or not. Alternatively, forecasts such as futures contracts can be viewed. Because buyers and sellers agree that they want to trade in the future. The contract, that is, the contract currently holds that intention.

Most Prediction Markets do not use fiat money, unlike, for example, stock exchanges. Instead, users use virtual money. That's one of the reasons why prediction markets are not subject to the strictest regulations of the financial regulators. On the other hand, the classification is justified by the fact that relatively accurate predictions can be made. The more people make a prediction, the more accurate it becomes. In a coin toss, however, it is different. Therefore, the platforms are not in the category “gambling”, but are of the type “skill game”.

Even though betting exchanges are among the prediction markets, the majority of platforms focus on securities. However, portals have their own trading mechanisms and substitute values such as tokens or shares. All transactions thus take place independently of the real exchange. Only the result is read from there. On prediction markets, participants bet against other affiliates. If a user buys cheap and sells expensive, he improves the forecast. Consequently, the better a user estimates, the higher the reward is from an increase in the value of his virtual shares. The markets are thus based on gamification and community principles.

When talking about an event contract, the contract concluded refers to a real event like a football match. In a categorical event, the participants expect a clearly defined result. For example, only one in two teams wins the game. If the event is a scalar event, the result moves in a certain range. Prediction markets are mainly used in predicting stock market movements, in the healthcare industry, in security (predicting terrorist attacks) and in market research. Their big advantage is that they have much more informative value than surveys.

How do decentralized prediction markets work?

Prediction markets using blockchain technology have the same objectives as “normal” prediction markets. But they differ in some points. The virtual currency used is either a cryptocurrency or a token based thereon. Because all decisions are stored decentrally, middlemen are completely eliminated. As a result, the fees for transactions are reduced or none at all.

What are the advantages of decentralized prediction markets?

Prediction markets have the capacity to include a lot of data, facts and figures. The principle has always been based on the crowd approach: information flows in quickly from a large number of users. They are processed and thus create piece by piece higher accuracy. Because prediction markets have proven to be extremely accurate oracles, they even use governments instead of alternative methods such as surveys.

Participants in decentralized prediction markets also benefit from all the advantages of blockchain applications: there is no authority that determines prices, there are waves of new betting games withholds information for manipulation, or wants money for services. The market is shaped by the actors in and with the ecosystem. In addition, a referee does not have to be replaced if eliminated. The arbitration decisions come from the community. Fees stay low or fall completely off.

In general, any predicted event can be represented as a tradable product on a prediction market. If the event occurs, you will be paid, if not, you go out empty. The price of a prediction market thus indicates the probability of occurrence of the events. Prediction markets can be implemented with both real money and virtual money deployments. In the latter case, especially the so-called gamification plays a crucial role, in which the motivation of the participants from game-typical elements such as rankings, progress bar, awards but also cash values, distinguished.

What are the advantages of prediction markets?

Below are some advantages of prediction markets.

- Bundling and aggregating the distributed knowledge of the participants

- Can be used for a wide variety of topics

- Ensure a more intensive discussion of the subject/product among the participants

- Comparatively inexpensive

- To predict the sales volume of a new product, participants in an in-house prediction market could be offered a number of shares in the form of a stock exchange, which represent the respective sales volumes. Equipped with a base of virtual cash, they can now buy these stocks and trade them over a period of time. If they are right with their predictions, they will be paid a certain cash value in real money.

Want free money?

|