Want Quick Money? Try These Methods! 👇

- Survey Junkie: Get paid per survey through this link with one of the highest-paying survey sites on the web.

- Arrived: If you want a simple way to earn extra cash on the side from your phone, look no further than the best real estate platform that pays you passive income.

Looking for places to grow your money without much risk is difficult these days, but finding these 10 saving money ideas might be a good place to start.

A lot of TopSavers ask me how can they escape debt and find how to save money fast. There's no magic pill, it is simple planning and focusing a few minutes each day on changing your finances. I speak with and come in contact with quite a few millennials who have no savings in their savings account whatsoever. That seems to be the biggest problem for most people, and I almost always provide them with this incredible plan on ways to save and changing up their finances and they all tell me how it really does work.

I'm here today to tell you the same advice I give them, and how you can change your finances and get out of the paycheck to paycheck way of living and find easy ways to save money even on a tight budget.

How Will This Work?

When you don’t have a good understanding of money it's difficult to properly manage it. Education on how to save money is the key to changing your money problems.

So, today I am going to help you with finding easy ways to save money. In order for this to be successful, you must track your savings in a new account or implement money saving apps or you won't be able to see your progress. If you track savings in the same checking account that you use for everything else, it doesn't usually work.

This is one big thing that most people forget to do, so now that you get it's important what should you do?

If you’re serious about getting things off on the right foot, I suggest you open a new savings account or use an account that is different than your daily bank checking account. Once you have one dedicated to tracking your savings, start depositing money—$1, $5, $10, $0.01—any amount is good. It’s just about getting over the hump, trust me!

How to Save Money: Start with the Basics

If you are saving more money, that's more money in your pockets. by utilizing these 10 helpful top savings options you can learn how to save money.

1. Get Paid To Watch Videos and Take Surveys

The first thing you can do is sign up for InboxDollars which pays you, in cash, to watch fun videos & take surveys and they'll also give you a $5 free bonus just to give it a try. By spending just 5-10 minutes per day on this (either on your lunch break or during TV commercial breaks) you can earn and save an extra $50/month. More people should be doing this!

2. Save 65% On Your Car Insurance By Comparing Rates

Yes, it may seem obvious but when was the last time you compared your car insurance rate? Most people just pay the monthly bill, whatever it may be but car insurance companies make all of their money off people who have been with them for the longest time. It's true, and if you have a clean driving record… have your premiums stayed the same or even gone up over that past few years?

Car insurance companies think you won’t leave once you’re with them, so they charge whatever premium they want. Personally, I compared rates just last month and switched from Geico to Allstate, as the premium was 65% cheaper. Insurify compares rates for all the major car insurance companies and it's free. So if you have 3 minutes of time, head on over to Allstate to check your options in order to start saving money.

Allstate was the cheapest option for me in my state of Virginia. However, the rates differ between states. I was impressed to learn something by switching companies, did you know at Allstate they pay you for safe driving? You should get to know all the ways your auto insurance can work for you.

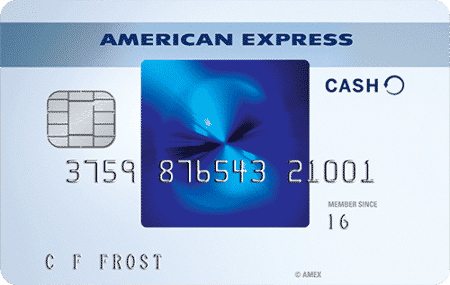

3. Stop High-Interest Rates On Credit Card Debt

If you're serious about saving money, then you should know about balance transfers. If you're paying only the monthly minimum each month then you're subject to paying money in interest alone and not even the principal balance.

An example is: If you have $2,000 on your VISA card, and it has an 18% APR, then you'll be paying $400/year in interest alone if you only pay off the monthly minimum each month. That's $400 down the drain.

You can avoid this by signing up for American Express Blue Cash Everyday. AMEX Blue Cash Cash Everyday is a card with no annual fee, and you can transfer your current debt from any type of credit card (all with no fees), and pay 0% interest for 12 months on your current debt amount. With no interest for 12 months, you can steadily pay down your balance with your savings from the other steps, which will save you a great deal of money in most cases.

For those with decent credit that have higher debt amounts that will need more than 12 months to pay it off, LendingTree can help you save thousands in the long run by refinancing your debt at rates as low as 5.99%. It only takes a few minutes to see how much you can save, and it's 100% free to give it a try.

And if you're credit isn't great or need some special help, then you should know about Prosper. They offer personal loans that can help you consolidate certain types of debt into one loan with a lower interest rate. Say hello to better finances with Prosper that offers loans with low, fixed rates and no surprises. All you have to do is sign up.

If you don't know your score current credit score, you can also check, completely free, with CreditSesame. Not only will they show you your score, but as part of their service, they’ll help you identify the different factors that impact your score and how to improve them, all for free.

4. Get Extra Income By Driving People In Your Free Time

The next thing you can do is register to drive with Uber – if you have a car, it's a perfect way to make a good amount of extra cash whenever it's convenient for you. A lot of people do this full time, so you can imagine that's it definitely possible to do this on the side and make extra money and be able to save it.

Once you're a driver you can choose to turn the app on or off and drive whenever you have some time to spare. They also have a feature that allows you to select your destination, so if you are leaving work (or any other long commute), you could pick up a ride that was going in the same direction. You can do this 3-4 times a week on your commute and can easily make up to $300 each month and save it all.

While for some this may seem like a nice little amount to add to your savings account, according to Uber, the national average in April 2017 was $601 a week… so it's definitely a good choice if you really want to earn extra income and start saving money.

Another ride-sharing option that's available to you is Lyft. Uber seems to be more globally known, however, if you're in the United States you probably have heard about Lyft. It's basically the same as Uber, but some argue that you make more as a Lyft driver.

5. Save $1000's By Refinancing Your Home

If you are a homeowner, then this one of the smartest things you can look into beyond the basics of home budgeting. I currently work as a Business Analyst at Freddie Mac, so I know a thing or two about the mortgage market. If you own a home and have not yet taken advantage of historically low refinance rates, you probably are spending way more than you should be on your mortgage.

LendingTree could help you refinance your mortgage at a significantly lower interest rate – Let's say you can lower your rate by around 1%, on a $200K mortgage, can save you over $100/month and over $40,000 in total over the course of your 30-year loan!

You can also save money by relocating to an area with a lower cost of living. For example, St. Louis is one of the best cities to raise a family and is budget-friendly.

Make Learning How to Save Money Fun…

If you’ve done everything on this list and didn’t spend the extra money, in a few months or so you should have saved and earned a total of at least $1,000. $1,000 is great, but what’s better? $5,000. You’re really not that far away if you can keep this going. If you're competitive in nature, you can make a game out of it to challenge some of your family and friends to see who can save the most: Click the share button below to see if any in your network wants to do the same!

Take The Following Actions Today

If you are looking for easy ways to save money then you should know that you do not have to stay living paycheck to paycheck, but it’s up to you to change it. If there is no change, then your situation won’t and can’t be different. Set a goal to take action today, and make a plan to break free. Start small if you need to and educate yourself. Knowledge is definitely powerful! Start by taking action today:

|

Get $5 For Free To Sign Up! |

|

Pay 0% For 12 Months Transfer Your Current Credit Card Debt Learn More |

|

Reduce Your Credit Card Debt Calculating Your Savings Is Easy & Free Learn More |

|

Drivers Earn On Avg. $15.89 an Hour With Uber Start Driving In Your Free Time!

|

|

Refinance Your Home and Save Calculate Your New Monthly Payment For Free Learn More |

Want to Become Better at Saving Money? Go Get It!

Yes, it may be difficult to save if you feel like you are living paycheck to paycheck. But even the most frugal individuals can find ways to save on a daily and monthly basis by doing simple tasks such as finding the best homeowners insurance rates or best savings accounts to stash your savings. it's simple, if you are saving more money then that's more money in your pockets.

Good luck utilizing these 10 helpful top savings options.

Up next:

- Frugal Clothing Tips: Buying Designer Brands On a Budget

- How To Start Saving Money Even if You’re Lazy

- How To Save Money Fast With a Click Of a Finger

- 10 Insanely Smart Ways To Save Money Fast

- 7 Ways to Graduate College Completely Debt Free

Want free money?

|